Debt payoff is an important step in any financial plan, but depending on what type of debt you have and how much debt you have will determine where it makes sense to prioritize debt payoff in your financial plan.

Types of Debt

Debt can be categorized a number of different ways, but for our purposes, we’re going to talk about debt in terms of the interest rate. So, the two types of debt we will discuss are:

- High Interest Debt

- High interest debt is commonly called consumer debt. Some examples include credit card loans and personal loans. As the name suggests, these types of loans generally have a high interest rate, which means you’re spending a lot of money on interest. This is the kind of debt that should be your focus when paying off debt. That being said, the methods we’ll discuss later in this post can be applied to any type of debt.

- Low Interest Debt

- Low interest debt includes mortgages and student loans, which generally offer much lower interest rates than consumer debt. As I said above, you can apply the debt payoff methods we’ll be discussing to any type of debt, however, keeping low interest debt can be a good financial move. For example, if you have a mortgage with an interest rate of 4% and your money can make 7% if invested in the stock market, mathematically you’re better off not making extra payments on your mortgage, but investing the funds. However, if you don’t save the money that you could be putting toward your mortgage, but rather spend it, then you’re better of making extra payments on your mortgage.

While paying off any debt is a good thing, as I said above I would recommend focusing initial debt repayment on high interest debt. If you’re curious about what financial steps I recommend before paying off low interest debt, look at my post on the Hierarchy of Savings, here!

Debt Payoff Methods

Paying off debt in any way is a good thing, but there are different methods that you can apply and depending on which method you choose, you can reduce the amount of interest paid and therefore the total repayment amount. We’re going to look at three options for paying off debt:

- Minimum Payment

- This method assumes that you are making the minimum payment required for each loan. Of the three methods we will discuss, this will be the slowest method to repay your loans, which also means you will spend the most money because you will pay more interest over the repayment period.

- Snowball Method

- This method assumes that payments will be greater than the minimum required payment. For this method, additional payments will be made on the loan with the smallest balance. This will result in that loan being paid off earlier than if only the minimum payment is made. When the loan with the lowest balance is paid off, you ‘snowball’ the entire payment from that loan (minimum payment + extra payment) as an extra payment on your loan with the next lowest balance. So, now you are paying the minimum payment for the second loan plus the entire payment (minimum payment + extra payment) from the now paid-off loan as additional payments. Every time you pay off a loan, you continue to ‘snowball’ your payments to the next loan until all your debt is paid off. So, while your overall monthly payment remains the same throughout this process, as each loan is paid off, you are able to make a larger additional payment on subsequent loans.

- Avalanche Method

- The avalanche method works similar to the snowball method, but rather than making your initial additional payments on the loan with the smallest balance, the additional funds are paid toward the loan with the highest interest rate. As above, when the highest interest rate loan is paid off, those funds are then used to make additional payments on the next highest interest rate loan. This method will result in the least amount of money spent on interest and therefore, the lowest overall cost.

I know this is a lot of words to explain a concept, so let’s look at an example to see this in action.

For our example, let’s talk about Alex. Alex has three credit card loans with balances, interest rates, and minimum payments as detailed in the table below. This example also assumes that no additional debt is being accrued during the repayment period. This means that anything Alex purchases with one of these credit cards during the repayment period is paid off in the month in which it was purchased.

As you can see in the table above, Alex’s loans all have different balances, interest rates, and minimum payments. If Alex chooses to follow the minimum payment method, he will pay $325.00 per month and it will take him 83 months (that’s almost 7 years!) to pay it off. However, if he can increase your monthly payment to $500.00 and apply the snowball or avalanche method, he can repay the loans in only 35 months!

Let’s break it down a bit more…

- Determine amount of additional payment

- For this example, we’re going to assume that the additional payment is $175.00 per month. This bring the monthly payment up from the $325.00 minimum payment to the $500.00 payment discussed above.

- For your purposes, you’ll want to take a look at your monthly spending and determine where you can make some cuts and how much to determine what additional payments you can make on your existing loans.

- Select your payoff method

- We’re going to look at the results of both the snowball method and the avalanche method, but you may be asking yourself, why, if the avalanche method will result in the lowest total payment would you select the snowball method? In some cases, your highest interest rate loan may have a significant balance. If you’re just starting out on your debt payoff journey, the snowball method will give you the quickest ‘win’, which can help motivate you to keep going! You can also use the snowball method to more quickly reduce the total number of monthly payments you need to make to simplify your finances.

- If you’re trying to decide what method to use yourself, decide if you want a quick win to motivate you. If you do, start with the snowball method, you can always switch to the avalanche method once you’ve gotten going if you’re confident you can maintain your debt payoff strategy!

- Determine loan payoff order

- As you can see in the table above, the loan payoff order is different for the snowball method (start with the lowest balance) and the avalanche method (start with the highest interest rate). For the snowball method, Alex will start by paying extra on Loan A, then Loan C, and finally, Loan B; however, with the avalanche method, he will start with Loan C, then Loan B, and finally, Loan A.

- Once you’ve settled on a payoff method, you’ll want to make a table similar to the table above for your own loans so you can determine the appropriate order for paying off your loans.

- Start making payments

- When you start making payments, consider automating your payments to hold yourself accountable to your debt payoff strategy. And of course, if you have more funds than determined in Step 1 in any given month, making extra payments will shorten your repayment period and reduce the interest paid overall.

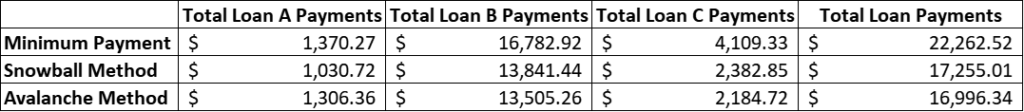

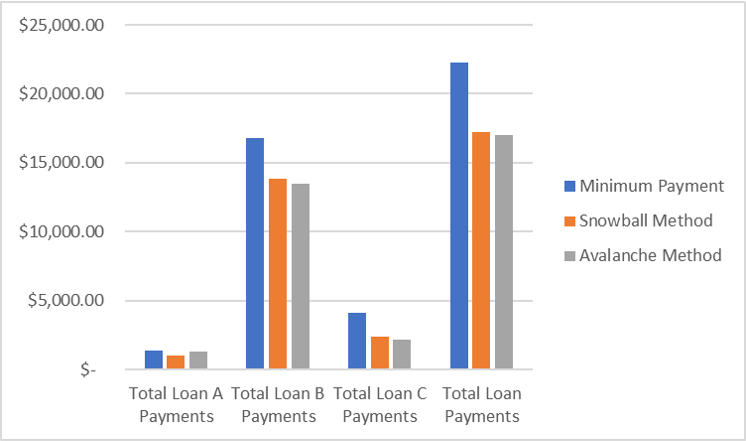

So let’s take a look at the results of these different payoff methods on Alex’s three loans:

Let’s first look at how much Alex will pay over the life of each of these loans based on which payoff method he selects. Remember, the loan balances equal $13,000, so anything above that amount is interest.

- Minimum Payment Method: If Alex chooses the minimum payment method, he will pay a total of $22,262.52 over the course of the payoff period, which means Alex is spending $9,262.52 on interest (that’s 71% of the amount of the original loan!).

- Snowball Method: If he chooses the snowball method, Alex will pay a total of $17,255.01. That means, in this case, $4,255.01 in interest is paid on these loans.

- Avalanche Method: If Alex chooses the avalanche method, he will pay a total of $16,996.34 over the repayment period, meaning he spends $3,996.34 on interest.

So, as you can see, the avalanche method will result in the least amount of interest paid overall, but using either the snowball or avalanche method and increasing his monthly payments to $500, means Alex can spend less than half the amount on interest over the life of these loans.

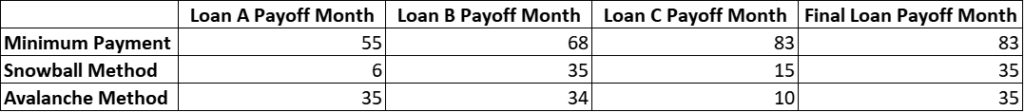

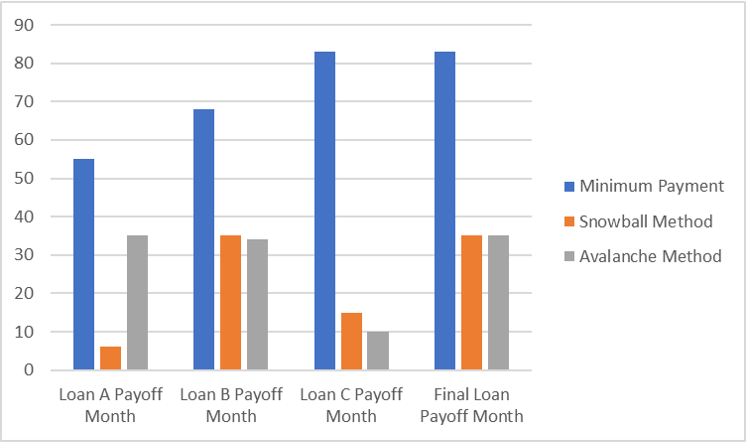

Similar to looking at the total amount paid based on the method selected, let’s also look at what Alex’s payoff period will based on his selection.

If Alex makes the minimum payments on his three credit card loans, it will take him 83 months to pay them off completely. As we said above, that’s almost 7 years! However, if Alex selects either the snowball method or the avalanche method to pay off his loans, he will have paid them off in 35 months, less than half the time!

As you can see, the payoff method that Alex selects will determine which of the loans will be paid off first. So, if Alex chooses the snowball method, Loan A will be paid off first because that is the loan with the smallest balance. However, if Alex chooses the avalanche method, Loan C will be paid off first because that is the loan with the highest interest rate.

As mentioned above, the avalanche method for debt payoff will result in the lowest total amount spent by eliminating higher interest rate loans first, however, both the snowball method and avalanche method result in much faster debt payoff with much less interest paid than simply paying the minimum required payment.

Conclusion

Once you’ve selected a debt payoff method, stick with it! It may take some time, or even a significant amount of time, depending on the amount of debt you’re working to pay off, but keep in mind the goal is to reach financial independence! When you complete your debt payoff, you’ll have a significant amount of money that was previously set aside in your monthly budget for debt payoff that can be reallocated to meet another of your financial goals.

Once you’ve gone through the debt payoff process, it is important to be intentional about any debt you take on.

Not all debt is bad debt. We’ve focused on credit card debt in our example, which is a type of consumer debt. Consumer debt has very high interest rates and does not increase in value. This means that when you buy something, like clothing, its value instantly decreases because it is now a used item. This type of debt is considered bad debt. However, some debt, like a mortgage, is considered good debt. A mortgage is considered good debt because mortgage interest rates are generally low and making the payments builds the owner’s equity in the home. So, now that you’ve done all the work to eliminate your debt, you want to avoid bad debt and only take on good debt if it fits into your budget and aligns with your financial goals.