With financial planning, as with many things, you want to get the biggest ‘bang for your buck’! So, the idea behind the hierarchy of savings is that, at any point in time, you may not have enough ‘extra’ money after covering your monthly expenses to touch on all the possible savings avenues, so which should you tackle first to maximize the benefit?

The first and most important part of financial planning is to live below your means. This means you MUST spend less than you earn. Living below your means will ensure that you have money available to put toward these various savings options.

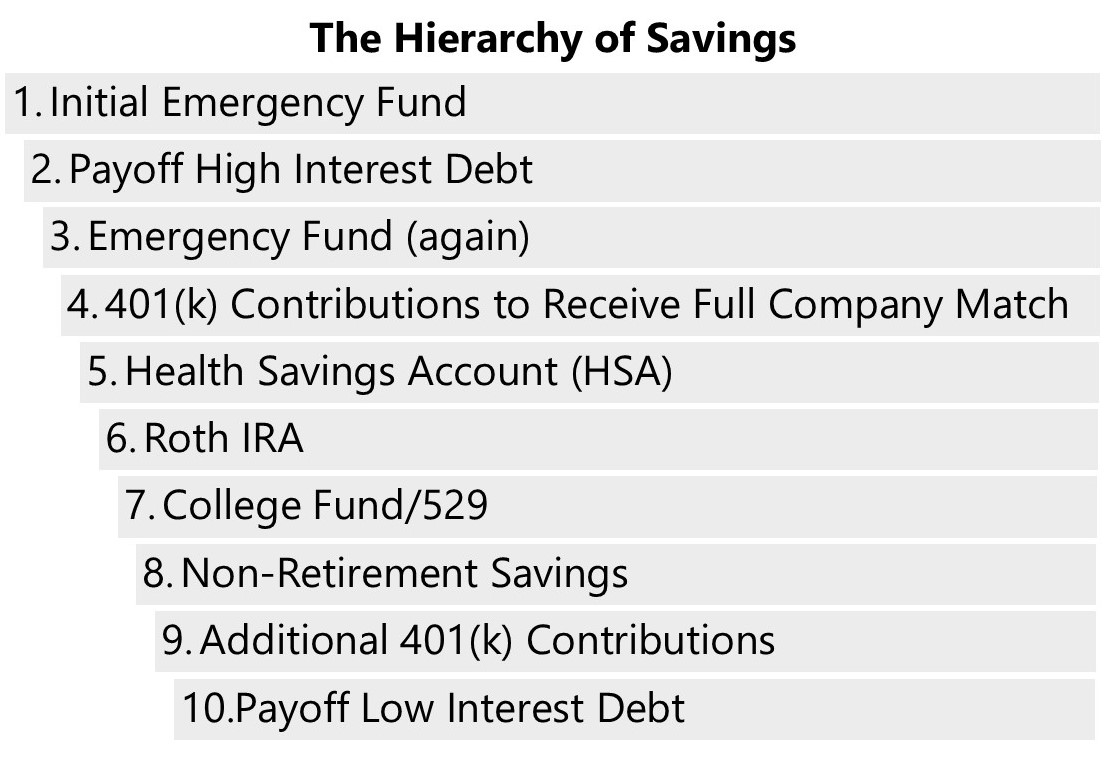

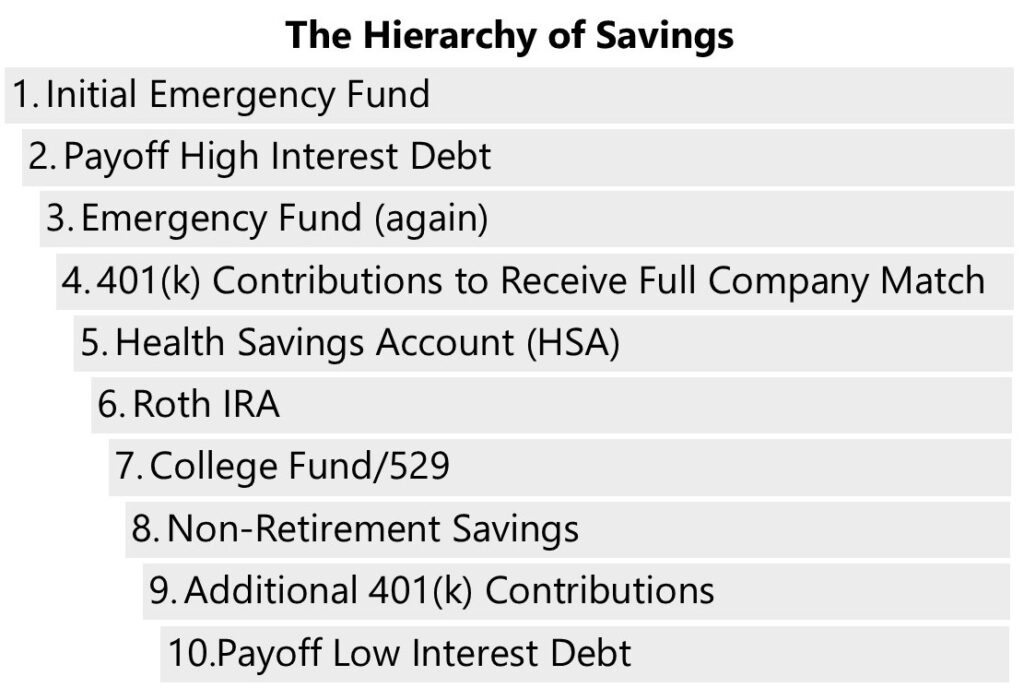

While your specific situation may call for some modifications, I recommend saving money in the following order:

1. Emergency Fund

While the goal is to have an emergency fund that can cover three to six months of expenses, start out by trying to save $1,000 to a high yield savings account to cover any emergencies. Then you can continue to grow your emergency fund while you start working toward the other steps in the hierarchy of savings. You don’t have to keep the entire amount of your emergency fund in a savings account, you can invest some of it into a money market account, cd, or even conservative stocks and/or bonds. You just need to make sure that you have some of the money readily accessible in the case its needed urgently.

2. Payoff High Interest Debt

This step will help you to increase your savings in other areas. What is considered high interest debt? This is going to be consumer debt, like credit card balances that aren’t paid off monthly. When it comes to paying off high interest debt, I recommend using the snowball method or the avalanche method.

The snowball method means that you pay more than the minimum monthly payment on the loan with the smallest balance, which will result in that loan being paid off sooner than if the minimum balance were paid. Once that loan is paid off you snowball the money used for those payments into the monthly payments for the loan that now has the lowest balance loan and so on.

The avalanche method works the same as the snowball method, but rather than starting with the loan with the smallest balance, you start by making extra payments on the loan with the highest interest rate.

The avalanche method is going to save you the most money in the long run by eliminating the loan with the higher interest rate first, but if that loan has a high balance, using the snowball method (at least to start) might keep you motivated because it will get you a ‘win’ more quickly by eliminating a loan sooner than the avalanche method might.

3. Emergency Fund (again)

Once you have paid off your high interest debt, I recommend using at least some of the funds that are now available for savings (since they are no longer being used to pay off debt) to continue building your emergency fund from the $1,000 you started with to the 3 – 6 months of expenses discussed above. You don’t have to use all of it to build your emergency fund though, in fact, I would encourage you to use a percentage of it for emergency fund savings and use the rest to move on to step 4, ASAP!

4. 401(k) Contributions to Receive Full Company Match

If you work for a company that has an employer sponsored 401(k) (or 403(b), etc.), they likely offer a company match for some amount of contributions that you make. This is free money. Let me say that again… THIS IS FREE MONEY!!!

You should be able to set up your contributions to be deducted from your paycheck automatically and you won’t miss money that you never had anyway! When getting started on your 401(k) contributions, keep in mind a couple of things:

- Some employers require you to contribute from each paycheck to get the full company match, rather than just the specified percentage over the course of a year. So, if you’re starting mid-year you may not be able to get a full company match for the first year, but don’t let that stop you!

- Some employers have a step-wise contribution match. For example, they may match 4% of your annual salary, but in order to get your company to contribute 4%, you need to contribute 6% because their contributions are stepped. They contribute the same amount dollar-for-dollar for the first 2%, but they only contribute $1 for every $2 you contribute from 2% to 6%. If your employer does this and you really can’t afford to set aside the whole 6%, start with 2% and work up from there.

- Many employers give you the option to contribute to your 401(k) with Roth or traditional funds. Roth funds are contributed after-tax, which means that when you take those funds out of the account to use them in retirement they won’t be taxed. Traditional funds, on the other hand, are contributed pre-tax, so when you withdraw those funds in retirement, they will be taxed at that time. Based on your current tax situation and expected tax situation in retirement you can determine which type of savings, Roth or traditional, are the best option for you.

5. Health Savings Account (HSA)

A health savings account (HSA) is a type of account that an individual or family are eligible for based on the type of medical insurance plan they have. In order to qualify for an HSA, you must be enrolled in a qualified High Deductible Health Plan (HDHP). If you are enrolled in health insurance through your employer and have the option to select a HDHP, your employer may provide ‘seed money’ or an initial contribution to your HSA each year. Yay, more free money! There is a limit on the amount that can be contributed to this account annually (which includes both employee and employer contributions). For 2024 the limits are $4,150 for an individual and $8,300 for a family.

HSAs are a great tool, specifically for tax purposes. You’ll often hear that these accounts are triple-tax advantaged and that is because:

- Money contributed to this account is excluded from your taxable income in the year in which it is contributed

- The funds can be invested in a health savings brokerage account (HSBA) and the growth is tax free

- If the funds are used for a qualified medical expense, they are not taxed when used

There is a lot to be said about HSAs, so we’ll circle back to that in another post!

6. Roth IRA

You can contribute to a Roth IRA if your modified adjusted gross income (MAGI) is below the specified limits. MAGI is a fancy way of saying a part of your income. This will be the majority of your income, but you can deduct certain things from your gross income to determine you AGI and MAGI. For 2024, you can contribute up to the limit into your Roth IRA if your MAGI is less than $146,000 for a single filer or less than $230,000 for couples filing jointly. If your MAGI exceeds these limits, you are able to contribute a portion of the total contribution limit up to a MAGI of $161,000 for single filers and $240,000 for couples filing jointly. For 2024, you can contribute up to $7,000 into a Roth IRA and if you are 50 or older, you can contribute up to $8,000.

The great thing about a Roth IRA is that the money is put into the account on an after-tax basis. That means you are paying taxes on the money you put into this account before you make the contribution. What this also means is that the money is not taxed when you use it.

For individuals who are not eligible to contribute to a Roth IRA due to the income limits there are other options, such as the Roth conversion option.

7. College Savings/529

My general philosophy when it comes to paying for my kids’ college education is that I would love to contribute, but I want to make sure that I’ve taken care of myself. I don’t want to pay for my kids’ college education at the expense of being able to support myself in retirement because have I really done my kids a favor if I paid for some (or even all) of their college education if I’m going to need them to support me in retirement? No, I don’t think so. I also want my kids to have some ‘skin in the game’ when it comes to college, so I’m not concerned with having them have to pay for part of their education. That being said, we’re setting aside money regularly into 529s for each of our kids, but we know that may not be sufficient to pay for the entirety of their college education.

While contributions to a 529 account are not deductible for federal income tax purposes, they are deductible in many states. Additionally, the funds in 529 accounts grow tax-free as long as they are used for a qualified education expense. And that education expense doesn’t have to be college, it can be trade school, it can even be used to pay for elementary, middle school, or high school tuition.

8. Non-Retirement Investments

I might lose some of you on this one, but so far, all of the savings options, other than the emergency fund, that we’ve talked about have been either retirement accounts or accounts that require funds to be used for qualified expenses to avoid penalties. I think it is very important to have some additional savings that aren’t limited. You can use these funds for other things you want to do before retirement, such as a home improvement, but they are also going to be crucial if you are interested in retiring early.

Funds in your 401(k) and Roth IRA are not accessible without penalty until age 59 1/2 and HSA funds cannot be used without penalty for anything other than medical expenses until age 65. That means that even if you have enough money in your 401(k) to retire at age 55, you will be penalized for accessing those funds for the next 4.5 years or you may have to defer retirement until you can access the funds in those accounts.

9. Additional 401(k) Contributions

While you could contribute funds in excess of those needed to get the company match in non-retirement funds, there are a couple of advantages to adding additional funds to your 401(k) via your employer.

- As we said above, you can set up your contributions to an employer sponsored 401(k) plan via payroll deduction, which means, you’ll never even see the money, so you’ll never even notice that you’re saving for your retirement.

- A lot of employers offer the option to automatically increase your contributions by a set percentage annually. If you receive an annual raise and you set this increase to occur when you receive your raise, you’ll automatically be saving more for retirement not only because your income is growing, but because you’re saving a higher percentage of your income. And, you won’t even notice the change, because you’ll likely still see an increase in your take home pay. If you use this automatic increase option, be sure to pay attention when your contributions are approaching the limit, so you can adjust accordingly.

There are contribution limits for 401(k)s for both the amount contributed by the employee and the amount contributed by the employer. For 2024, the employee contribution limit is $23,000, unless the individual is 50 or older, in which case, they can contribute $30,500. The combined employee and employer contributions cannot exceed $69,000 (or 100% of income) in 2024.

10. Payoff Low Interest Debt

What is low interest debt? Things like your mortgage or student loans are low interest debt. I’m of two minds when it comes to paying off low interest debt, while it is nice to not have to think about another monthly payment, if you were going to look strictly at the math, it doesn’t make sense to pay off low interest debt if you can earn more by investing your money in the market. For example, if your mortgage interest rate is 4%, but you can earn on average 7% per year in the stock market, you’ll come out 3% ahead by investing your money rather than using it to pay down your mortgage balance.

Another consideration when it comes to paying off low interest debt is the amount of remaining debt. If there is a relatively small amount left on a mortgage or loan, it may be easier to pay it so you don’t have to think about it anymore even though you could technically do better investing the funds.

Conclusion

So let’s recap, here’s an overview list of my recommended hierarchy of savings. While saving money in any order is a good thing, we’re trying to maximize the benefits to you by saving according to this plan.

And as I said at the beginning of the post before you can begin working through this hierarchy of savings, it is imperative that you are living below your means, so you have money to use for savings. I know budgeting is like a four-letter word to a lot of people, so if you’re not ready to start out by setting a budget, try tracking your spending for a start. If you’re looking for ideas for tracking monthly expenses, see my post here!

Let’s get saving! Please let me know what you think about the hierarchy of savings and what you agree or disagree with!