When most people hear the word budget, they cringe. Preparing and following a budget can be difficult, so oftentimes people put it off or skip it altogether. There are many different budgeting methods. I’ve heard of the 50/30/20 method, the envelope method, the zero-based budget, the pay-yourself-first budget… and many more. It doesn’t matter what budgeting method you choose to follow or if you choose to follow none at all, the most important tenant of any budgeting method is to live below your means.

I don’t perform budgeting according to a specific methodology, rather, I set automatic monthly investments and use monthly expense tracking to determine the ‘extra’ savings in a monthly period. Then at the end of the month any ‘extra’ savings is transferred to a savings account. While I have used a variety of tools in the past, I currently use Excel as my main financial tracking tool. I know that having an easy-to-use tool makes any job easier, so I’ve created a downloadable template based on the method I use for tracking my personal finances. Grab a copy for yourself and follow along!

My Excel file currently has three tabs:

- Net Worth

- Monthly Expenses

- Emergency Fund Savings

Net Worth

Net worth is calculated based on your assets and liabilities. Your assets are anything with a positive monetary value (bank/investment account balances, home value, etc.), while your liabilities are anything with a negative monetary value (mortgage, car loan, student loans, etc.). Put in equation form,

Net Worth = Assets – Liabilities

Years ago, I read that everyone should track their net worth as that is a good indicator of the health of your personal financial plan. Over time, you should be seeing an increase in your net worth, unless you are spending more than you are earning. If you are seeing a decrease, then it is time to evaluate your spending and make some adjustments.

I started tracking my and my husband’s combined net worth monthly. I have used a number of tools over the years to do this. For a long time I used Mint, which automatically pulled the balances from various accounts and provided net worth, which I then recorded in Excel. When Mint was shut down, I switched to Empower, which likewise allows you to link accounts and track net worth over time. One thing that I have found with every tool I have ever used to try to track net worth is that I cannot get all of my accounts connected, so I have to pull the balance of at least one account separately and add it with the net worth value from the tool I’m using in Excel. I also like that I can look back to the beginning of when I started tracking net worth. With some of the tools I have used, you were limited in how far back you could look at the information.

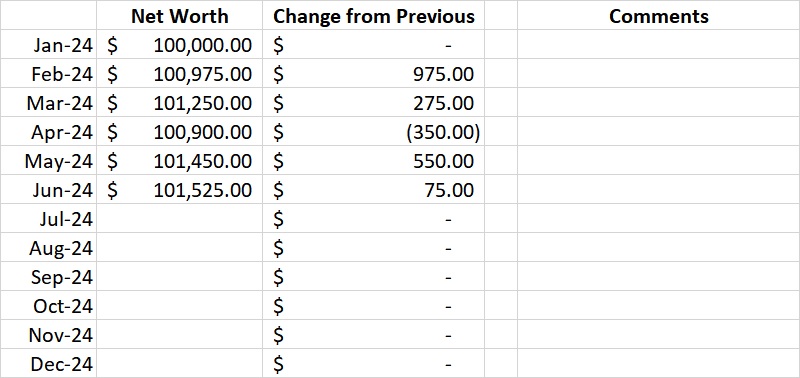

As you can see in this example, I note the value on a monthly basis. I have a reminder set on the first of each month to pull net worth from my tool and I plug the value in. Overall, this takes about a minute. Then, based on the equation that is already entered into the file the difference between the current month and the previous month is automatically calculated. As with anything finance, you can have months of positive and negative change, but overall, your net worth should increase over time.

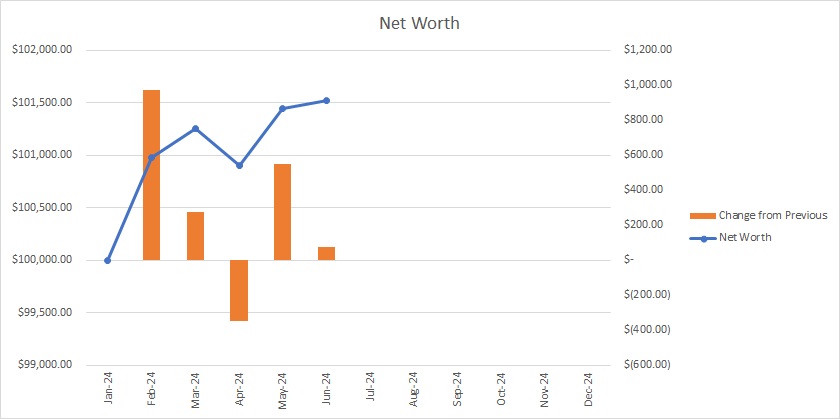

In addition to noting net worth every month, I also have a graph showing net worth over time and change from previous month (be aware the values are using different y-axes!). This allows me to see how my net worth is trending and if there has been a major change (up or down). When there is a major change from month to month I make note of the reason in the comments line of the table above. For example, in April 2020, our net worth decreased significantly due to a drop in the stock market as a result of the COVID-19 pandemic.

Monthly Expenses

This is the tab I spend the most time in. I use it almost every day!

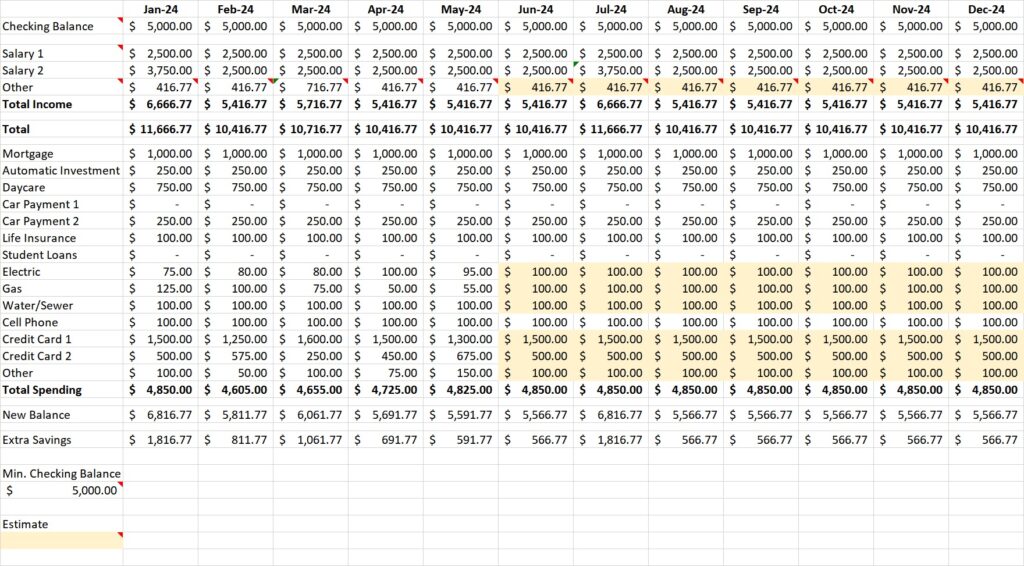

This tab is focused on the funds coming into and going out of our checking account. In this tab, I list our start-of-month balance, income, expenses, end-of-month balance, and ‘extra’ savings.

Start-of-Month Balance

My husband and I have determined a set amount that we want to have in our checking account at the start of each month. So my finance tracking file’s monthly expenses tab starts out with that value in row B. If you’re following along, you can choose an appropriate value for yourself or you can let this value change month-to-month.

Income

The income section of my finance tracking file has three lines: my income, my husband’s income, and other income. Again, if you’re following along, you can add/remove lines to this section as are appropriate for your situation. My salary is paid monthly, but my husband’s is paid bi-weekly, so while my salary is the same every month, there are some months where my husband gets three paychecks rather than two. Other income includes things like reimbursements from our daycare FSA, work expense reimbursements, account interest, etc. This section needs to account for all money coming into the checking account over the course of the month to ensure that the numbers all add up.

Expenses

I have broken the expenses down, so each category is an amount that comes directly out of our checking account. If you’ve downloaded my template and are following along, you can add or remove rows in this section to cover your specific expenses. Because the values are based on the amount coming directly out of our checking account, everything we put on our credit cards is lumped together into one line item. With most budgeting methodologies, expenses are tracked in the month they are incurred, so if you purchase a $5 coffee on your credit card, you count that $5 toward this month’s expenses even if the credit card won’t be paid off until next month. I however, track credit card expenses based on the month in which they are paid. For example, one of our credit cards closes on the 15th of the month, so any spending put on that credit card between the 1st and the 15th appears in the credit card balance for that month, while any spending after the 15th will appear in the credit card balance for the following month. The reason I track credit card expenses in this way is to ensure that my checking account balance matches my calculated end-of-month balance.

If you’re trying to reduce you spending, you may need to be more detailed in tracking your expenses by categorizing your spending. Once you have categorized your spending, you can see which categories account for the largest part of your spending. Based on which categories are required or optional and the percent of your total spending they account for, you can decide where to focus on making spending reductions.

End-of-Month Balance

The next step is to total income and expenses and add them to my start-of-month balance to calculate the account balance at the end of the month.

If you’re following along in the downloadable template, this calculation is built in, as is the ‘extra’ savings calculation for the next step.

‘Extra’ Savings

‘Extra’ savings is simply any additional money left over when expenses are subtracted from income, you can also determine this amount by subtracting your set start-of-month balance from your end-of-month balance.

Income – Expenses = End-of-Month Balance – Start-of-Month Balance = ‘Extra’ Savings

I transfer this money into a savings account (emergency fund) at the end of the month. In the downloadable template, this value is automatically entered on the Emergency Fund Savings tab, but you can overwrite it if you are not moving the full amount to your emergency fund account.

I like that with this method, I can look out months in advance and I can update expected future expenses based on averages from past months. I can also make changes to my estimated expenses based on seasonality (e.g. our home is heated via gas, so I increase the amount for gas in the colder months) or one-time expenses (e.g. I can increase our expected credit card bill around the holidays).

Emergency Fund Savings

In this tab, I track the amount of money in our high-interest savings account, which we use as our emergency fund. Our goal is to have three months of expenses in this account. We also have money invested in non-retirement brokerage accounts should we need additional funds for a large emergency. At the end of each month, I transfer our ‘extra’ savings to this account. We generally do not to take money out of this account, but we do make occasional transfers for larger expenses (e.g. planned home improvements or home repair expenses) and to make annual deposits into our Roth IRAs.

If you want to try this method, click here to download my free template: